Nurturing New Growth – Moneyweb

South Africans are accustomed to receiving unfavorable news, but recently, the updates have been more optimistic. Inflation has significantly decreased, and last week, the Reserve Bank made another interest rate cut.

When examining the latest inflation figures for South Africa in isolation, it suggests that an even larger cut in interest rates might be warranted beyond what was announced.

ADVERTISEMENT

CONTINUE READING BELOW

Read: MPC repo rate misfire

However, it’s essential to recognize that South Africa doesn’t exist in isolation—either physically or metaphorically. It functions within a multifaceted global context.

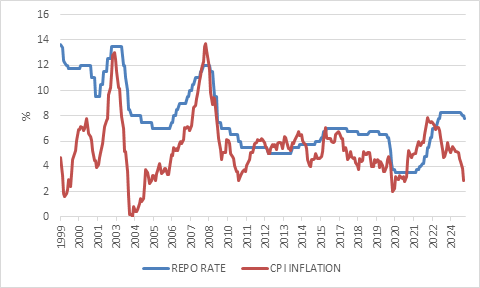

Through the floor

Consumer inflation dropped below the lower end of the 3% to 6% target range in October for the first time since February 2021, when the pandemic disrupted global pricing structures. This disruption caused prices to rise, resulting in global and local inflation spikes throughout 2022 and 2023.

Prior to that, inflation also briefly dipped below 3% in 2010 due to a global financial crisis and volatile oil prices.

In 2004, inflation hit 0% after the rand appreciated significantly, moving from R11 per dollar to R6 between 2002 and late 2004.

The primary factor this time has been the considerable drop in goods inflation, specifically in food and fuel prices.

Goods inflation stood at 1.4% year-on-year in October. Conversely, it was goods inflation that mostly contributed to the surge in headline inflation beyond the target range in 2022.

Goods prices account for 49% of the South African consumer price index, while services make up the remainder. Service inflation tends to be more resistant and grows at a slower pace. It is arguably more dependent on domestic demand, whereas goods prices are significantly influenced by international markets. The encouraging news is that service inflation has been on a downward trend, falling to 4.3% in October, although it is important to note that considerable electricity tariff and medical aid hikes are yet to be seen in the figures.

This implies that the sub-3% inflation reading for October is likely a temporary phenomenon.

SA repo rate and consumer inflation

Source: LSEG Datastream

Unanimous

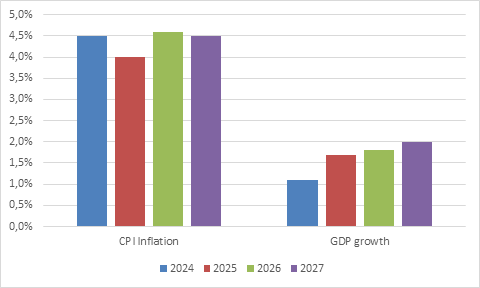

The Monetary Policy Committee (MPC) of the Reserve Bank unanimously opted to reduce the repo rate from 8% to 7.75%, continuing their methodical approach to rate cuts.

The Reserve Bank anticipates inflation to average around 4% next year, stabilizing near the 4.5% target in 2026 and 2027. These growth forecasts are largely in line with previous estimates, predicting a rise to 2% by 2027, which remains conservative relative to various private sector predictors.

The MPC statement indicates that the risks surrounding economic growth appear “balanced”—meaning that either direction could deviate from the forecast. If viewed as leaning to the “upside,” it would imply the forecast may be more prone to underestimating than overestimating.

Read:

Just a 25bp cut by Sarb

Inflation at four-year low before rate decision

The statement also reflects a balanced view regarding risks to the inflation forecast.

Nonetheless, both the statement and Reserve Bank Governor Lesetja Kganyago highlighted numerous factors that could exert upward pressure on inflation, such as local electricity tariff hikes and, more crucially, growing global uncertainty following the US elections.

The statement emphasized that “new inflation pressures and increased uncertainty” imply reduced policy flexibility for central banks globally.

Reserve Bank growth and inflation forecasts

Source: SA Reserve Bank

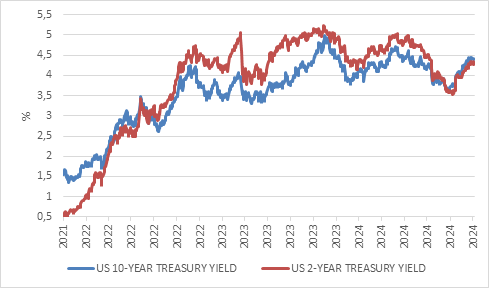

In simpler terms, if the interest rate disparity between the US and other countries widens because the Federal Reserve implements fewer cuts compared to other major central banks, capital will tend to flow toward the US, strengthening the dollar. A stronger dollar implies weaker currencies elsewhere, potentially causing higher inflation. As a result, central banks with these currencies may reconsider planned interest rate cuts to prevent severe currency fluctuations.

The South African Reserve Bank, in particular, is always wary of the risk of a chaotic depreciation of the rand, which may lead to rising inflation. Although the current exchange rate, roughly R18 per dollar, isn’t alarming, any sudden drop following the US election may raise concerns.

Read: Cagey Sarb to cut rates sparingly in 2025

Before attributing everything to president-elect Donald Trump, it’s important to note that the outlook for US interest rates began to shift prior to the election due to strong economic growth and persistent inflation trends.

Another ongoing inflation concern is the potential spike in global oil prices, especially after Russia launched missiles at Ukraine. However, with Brent oil priced at $75 per barrel, it remains on the lower end of its trading range for the past two years. In rand terms, oil prices are still lower than a year ago, which contributes to the reduction in headline inflation. However, this also sets a lower reference point for inflation calculations moving forward. These factors play a role in the MPC’s cautious approach.

Target

The issue of whether South Africa should adopt a lower inflation target is still undecided. Officially, no conclusions have been reached, and the MPC will base policy on the current target of 3% to 6%.

While National Treasury sets the inflation target, the MPC retains operational flexibility in achieving it.

Kganyago noted that discussions with Treasury regarding this matter are ongoing and asserted that the MPC has not “implicitly or informally” lowered its target.

ADVERTISEMENT:

CONTINUE READING BELOW

As he correctly stated, “there’s no point in establishing a target that remains a secret, as its usefulness relies on influencing inflation expectations.” In essence, the public needs to be aware of the target and confident that the central bank is committed to achieving it.

Read: Kganyago says inflation target review nearing end

Since 2017, the MPC has explicitly aimed toward the target’s midpoint and communicated this to the public. The anticipated inflation level stabilizing around this midpoint suggests a degree of success. The public now seems to accept that inflation should hover around 4.5%.

Consequently, the MPC could begin to emphasize the lower end of the 3% to 6% target range in their communications, paving the way for a potential formal reduction of their target without necessarily influencing short-term interest rate decisions.

In the long haul, a lower inflation rate would benefit the nation by leading to reduced interest rates over time, less depreciation of the rand, and a more stable business environment.

However, the adjustment period may be challenging, as interest rates could be higher in the short term than would otherwise be necessary. For instance, if the target is officially set at 3%, a 4% inflation projection for the next year would be viewed as excessively elevated, limiting further rate cuts. That said, it does not imply imminent rate hikes.

A repo rate of 7.75% combined with an inflation rate of 4% generates a real repo rate of 3.75%, which the bank would classify as “restrictive.” The Reserve Bank considers a real repo rate around 2.75% to be “neutral.” Rates above this level are thought to hinder domestic demand, while those below stimulate it.

Navigating by the stars

The concept of a neutral interest rate—where supply and demand within the economy achieve a stable balance, exerting minimal inflationary or deflationary pressures—is not without complications. Intuitively, this idea is sound. Yet in practical terms, it is challenging to measure directly.

We can only ascertain whether interest rates are excessively high or low through observation of their effects on economic activity, particularly in interest-sensitive sectors like housing and auto sales.

Looking back, we can categorize rates as “restrictive” or “accommodative” based on economic performance, yet it is difficult to project those relationships moving forward.

The estimation of a 2.75% neutral real repo rate, commonly referred to as r* by economists (pronounced r-star), may be on the higher side for the South African economy. Most South Africans borrow at rates tied to the prime lending rate, which is 3.5% higher. A real neutral prime rate of 6.3% is steep when real economic growth is below 2%.

Furthermore, the situation surrounding r* raises questions within the US context, where real interest rates have consistently exceeded the estimated neutral rate of approximately 0.5% to 1%. Despite this, the US economy has exhibited resilience. This could indicate that the neutral rate is higher than previously believed or that unique factors, like expansive fiscal policy, have mitigated the impacts of a higher r*.

Although unobservable, the Federal Reserve must form an opinion on the positioning of r*. As Fed Chair Jerome Powell remarked, policymakers “navigate by the stars” while contending with uncertain conditions.

Investors similarly need to assess whether interest rates stand at an excessive level, are too low, or are adequately balanced.

If rates are deemed excessively high, economic strain will mount, ultimately diminishing corporate profits and, consequently, the stock market. Conversely, if rates are perceived as too low, the economy may experience renewed growth, producing short-term earnings boosts and potentially increasing share prices, but this would also reignite inflation, perpetuating a cycle of rate hikes.

Currently, market expectations indicate that short-term rates are likely to decline, although not as dramatically as previously anticipated, as suggested by rising bond yields. Notably, these yields have not surpassed previous highs. Additional rate hikes remain a possibility.

US bond yields, %

Source: LSEG Datastream

In South Africa, we can presently rely on lower domestic interest rates to deliver further relief to consumers.

While a gradual reduction cycle is anticipated, it aligns with decreasing inflation, enhancing the real purchasing power of households. This has already been reflected in a notable increase in retail sales in the third quarter, in advance of financial injections from the two-pot pension withdrawal system.

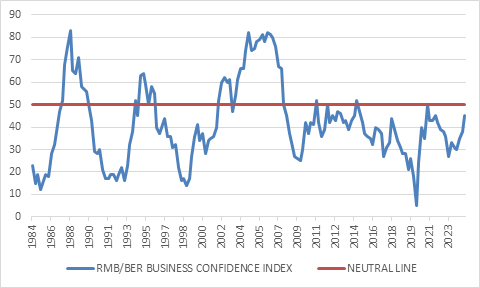

Furthermore, business confidence, as reported by the Bureau for Economic Research’s longstanding survey, has significantly improved over the past three quarters, although the index remains in negative territory.

A growing number of businesses exhibit optimism, even though a slight majority still express pessimism. Challenges persist within the business environment, including water supply issues in Gauteng and surrounding regions. South African businesses have demonstrated remarkable resilience amid challenging conditions; however, they ultimately rely on consumer spending, which now appears to be increasing.

Business confidence in SA

In summary, we are observing the initial signs of an upturn in South Africa’s economic performance, which can be further nurtured through declining interest rates.

Despite the unpredictable global backdrop, this presents a promising outlook for the long-term returns of South African asset classes that remain attractively priced.

Izak Odendaal is an investment strategist at Old Mutual Wealth.

Follow Moneyweb’s extensive finance and business coverage on WhatsApp here.