What Version of Trump Are We Dealing With?

The last week was nothing short of chaotic. We find ourselves just 20 days into the second Trump administration, with 1,441 days still ahead.

It all began with US President Donald Trump announcing significant 25% import tariffs on Canada and Mexico, alongside a 10% tariff on China. As expected, the market responded negatively. Following discussions between Trump and the leaders of Mexico and Canada, the implementation of the tariffs was temporarily suspended.

ADVERTISEMENT

CONTINUE READING BELOW

Read:

Both Mexico City and Ottawa pledged to enhance border control, a minor concession to avoid the potentially disastrous effect on their economies, as approximately 80% of their exports go to the US.

Meanwhile, the tariffs on imports from China will remain in effect, adding to those imposed during Trump’s first term, which former president Joe Biden chose to uphold.

China has responded with some tariffs of its own but is cautious, as it stands to lose more in a trade conflict than the US, resulting in a measured response.

Read: Xi’s careful response to Trump tariffs indicates China has more at stake

China could opt to allow the renminbi to depreciate to counter the tariff effects; however, such a move could further irritate the US and send negative signals domestically, potentially prompting capital flight.

South Africa

Trump also surprisingly targeted South Africa, leaving many wondering if he even recognized its existence.

His remarks regarding the new Expropriation Act are grossly misinformed, as the constitutional protection of property rights remains intact, but could nonetheless damage South Africa’s image.

Listen:

Other Trump associates also criticized the country’s black empowerment initiatives and its perceived anti-American stance.

Read:

Trump halted American aid to South Africa, primarily directed toward HIV/Aids treatment, but it should be noted that U.S. assistance to other nations has also faced cuts. This is unfortunate given that it constitutes a small part of the overall U.S. budget yet significantly impacts poorer regions.

The two Trumps

A complicating factor for investors globally is the uncertainty surrounding the nature of Trump’s leadership.

Will we see the ‘Art of the Deal’ or the ‘Time to Get Tough’ version of Trump, as described in the titles of two of his books (or rather, books he had ghostwritten for him)?

Last week showcased the ‘Art of the Deal’ Trump. The tariffs were swiftly suspended when Mexico and Canada offered minor concessions. For Trump, securing a perceived victory seems paramount—any party, ally or adversary, can negotiate with him.

Read:

This persona of Trump is likely to bring volatility and uncertainty but may not effect substantial change.

The ‘Time to Get Tough’ Trump may still loiter in the background. If he is genuinely committed to fundamentally reshaping the U.S. economy and its global relationships—something some of his close advisors certainly advocate—it could signal downside risks for both global and U.S. growth.

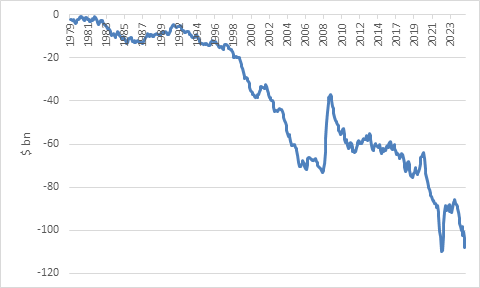

The U.S. imports more than it exports and, as a result, maintains a considerable trade deficit. Trump and many advisors perceive this as the U.S. subsidizing countries that exploit the situation. Although there is some merit to this perspective, it often oversimplifies the situation.

The U.S. deficit reflects the strong consumer demand of American households and mirrors the significant U.S. capital account surplus.

Simply put, the U.S. imports iPhones while selling Apple shares to the rest of the world.

When the U.S. imposed tariffs on China in 2018, imports from China fell, but imports from other nations increased, resulting in an overall rising deficit consistent with ongoing consumer spending growth.

US trade balance

To reduce the overall trade deficit, U.S. consumers must cut back on spending and increase savings, while foreign investors will need to lessen their purchase of U.S. stocks and bonds, indicating a substantial trend shift from previous decades.

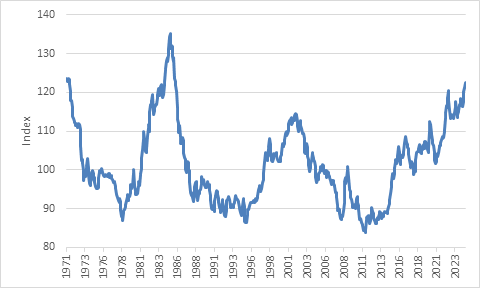

A weaker dollar could facilitate this by reducing imports of goods and foreign acquisitions of financial assets. However, the dollar remains exceedingly strong. On a real trade-weighted basis, the dollar has only been more robust in 23 of the 647 months since floating freely in 1971.

At this juncture, many would welcome a weaker dollar. It would enhance U.S. competitiveness and ease pressures on other nations burdened with dollar-denominated debt.

Real trade weighted US dollar

The scenario in China mirrors that of the U.S.: excessive savings, a heavy reliance on exports, and insufficient domestic consumption.

In an ideal scenario, the world’s two largest economies would agree on a simultaneous rebalancing in opposite directions while allowing the renminbi to appreciate against the dollar.

A similar arrangement occurred among the U.S., Japan, Germany, and others in the mid-1980s—the so-called Plaza Accord—around the last period when the dollar was this strong. Given the escalating tensions between the U.S. and China, such a resolution appears unlikely now.

Taking a broader view, there’s a plausible possibility that instead of restoring American greatness, Trump could undermine its foundations.

The U.S. is uniquely positioned geographically, shielded by two large oceans, and has a sizable population along with abundant natural resources.

However, its wealth and power derive from robust institutions, including courts, regulators, and governmental organizations, all of which have benefited from both skilled and unskilled immigration throughout its history.

The rule of law, the independence of the central bank, and advanced domestic and foreign intelligence services, coupled with a cutting-edge military, collectively contribute to the U.S. being the world’s most powerful nation.

By eroding these institutions and appointing loyalists to key roles, Trump could risk weakening rather than strengthening the U.S.

Such actions may inflict more harm on the dollar’s status as the reserve currency than any plans that Beijing or Moscow could devise.

However, these considerations exist in the hypothetical realm of ‘What if?’ and ‘What next?’. It’s easy to become distracted by the noise and overlook the tangible developments currently unfolding.

ADVERTISEMENT:

CONTINUE READING BELOW

First, last Friday saw the monthly release of U.S. employment data. Employment growth decelerated more than anticipated, yet the monthly payroll figures have been volatile and noisy for some time.

The year-on-year growth rate remains consistent with the long-term average of 1.4%. While this represents a solid yet unremarkable employment growth rate, it underpins household earnings, particularly as various indicators show wage growth around 4% year-on-year, comfortably outpacing inflation.

Real income growth bolsters consumer spending, indicating minimal near-term risks of a U.S. recession. A recession in the U.S. would be the worst-case scenario for investors in risk assets globally. Trump might generate volatility, but a recession would lead to a bear market.

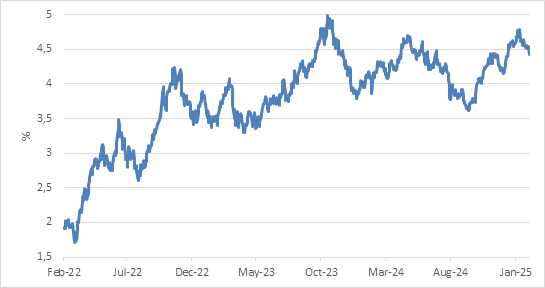

Second, central banks continue their operations. The U.S. Federal Reserve appears to be on hold for the foreseeable future. Even prior to Trump’s tariff announcements, stagnant inflation, robust income growth, and low unemployment (4%) diminished the prospects for further rate reductions. The uncertainty stemming from tariffs, immigration, and other aspects of the new administration’s economic policy encourages a ‘wait and see’ strategy. Tariffs will likely raise prices, although the extent remains uncertain.

The Fed will likely overlook the initial price increase effects and focus instead on the subsequent repercussions, specifically whether prices of goods unaffected by tariffs rise in reaction, whether selling prices surge due to heightened input costs, and whether workers push for increased wages to compensate for rising prices.

Nonetheless, imported goods constitute a minimal proportion of the overall U.S. inflation basket, which is heavily biased toward services.

US 10-year bond yield

Currently, there’s nothing indicating that the Fed will need to begin elevating rates, which could lead to a significant global market downturn.

In fact, U.S. long bond yields have recently dropped and remain within a narrow range, suggesting that the market doesn’t anticipate increased rates and may be adjusting expectations downward.

This is a relief since significantly higher yields could signal concerning trends while simultaneously raising borrowing costs for businesses and households.

While the Fed often attracts attention, a considerable number of borrowers have loans tied to bond yields, especially regarding mortgage rates. When the Fed raised rates, many U.S. homeowners remained unaffected due to fixed-rate mortgages that locked in low borrowing costs prior to 2022. However, this also implies less immediate benefit from the Fed’s reduction of its policy rate.

Read: World inflation may be reignited with Trump’s trade war

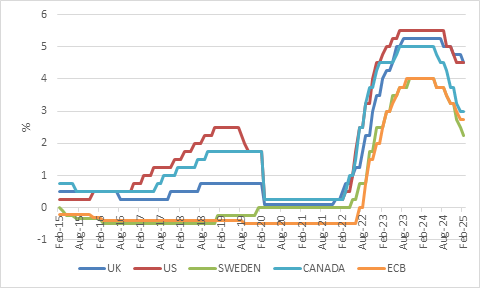

In Europe, central banks are making cuts despite inflation risks associated with depreciating currencies. The European Central Bank, Swedish Riksbank, and Bank of England have all reduced rates within the past fortnight. Eventually, such rate reductions will engender a stimulative impact.

Eurozone and UK equities have surged to near-record heights.

The floating rate loans that incurred significant pain when rates were increasing will provide more immediate relief compared to the U.S.

Central bank policy interest rates

Sona scan

Third, despite the unfavorable perception currently surrounding South Africa, it is unlikely to obstruct the positive changes taking place within the country.

Maintaining good relations with the U.S., a crucial trading partner and a significant source of foreign investment, is essential. The most immediate threat may come from potential disruptions to duty-free access to the U.S. market through the African Growth and Opportunity Act (Agoa), which encompasses around one-third of South Africa’s exports to the U.S.

President Cyril Ramaphosa’s State of the Nation Address (Sona) aimed to assert South Africa’s sovereignty while simultaneously extending an olive branch to the U.S.

However, the recent events should emphasize the urgency of getting South Africa’s internal matters in order, especially in such an unpredictable global context.

It was significant that the majority of Sona focused on economic growth and public service enhancements. It appears that tensions within the government of national unity (GNU) that have surfaced recently have eased, and compromises on sensitive subjects like