Redstone Implements Oracle Support for World Chain, Launches RED Token for Pre-Market Trading

RedStone has unveiled a strategic alliance with World Chain to deliver oracle support, coinciding with the pre-market launch of its RED token on Binance Launchpool and Bitget Pre Market.

Redstone (RED), a modular blockchain oracle provider, recently announced that it will supply World Chain with oracle support. This collaboration will enable smart contracts on World Chain to access precise price feeds, market data, and other essential information needed for DeFi applications on World Chain (WLD).

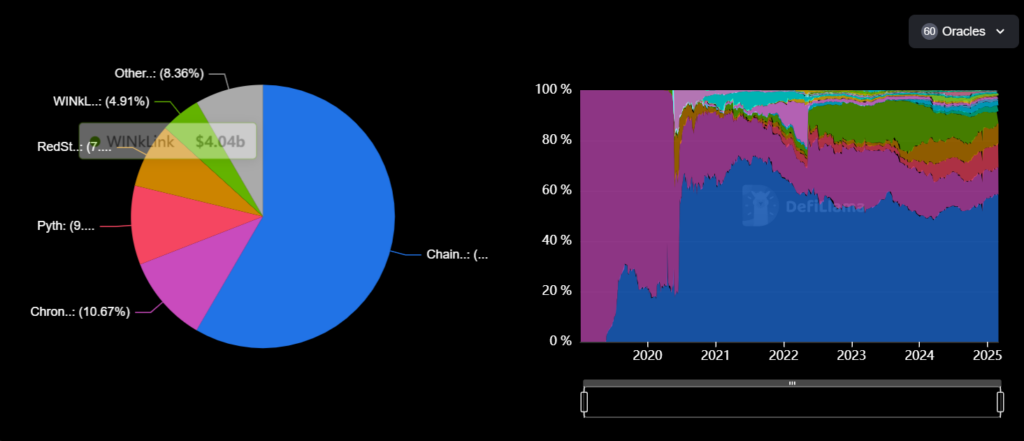

Established in 2020, RedStone specializes in providing real-world data to smart contracts, akin to Chainlink (LINK) and Pyth Network (PYTH). What sets RedStone apart is its modular architecture, which facilitates quicker integration with new blockchain networks. A notable instance of its modular capability is its integration with The Open Network (TON) blockchain, where RedStone became the first and sole oracle following a four-month integration process. RedStone also pioneered oracle support for projects like Ether.Fi and Renzo during the rise of liquid restaking tokens.

Moreover, RedStone employs a pull-based model for data access, differentiating itself from traditional oracles that continuously transmit data to the blockchain, a process that can be slow and expensive. In the pull-based framework, smart contracts request only the specific data they need at the moment they require it, resulting in reduced costs and diminished network congestion.

Currently, RedStone ranks as the fourth-largest blockchain oracle, providing support for 62 protocols (including Ethereum and Base) and managing approximately $6.5 billion in value, according to DefiLama. It also supports the recently launched project Berachain as of February.

In addition to its support for World Chain, RedStone has recently launched its RED token on Binance Launchpool and Bitget Pre Market. While Binance imposes participation limits due to regional restrictions, Bitget Pre Market offers open access, allowing anyone to trade RED early. The token has also been listed on MEXC, with deposits currently open and trading set to commence once liquidity requirements are fulfilled.

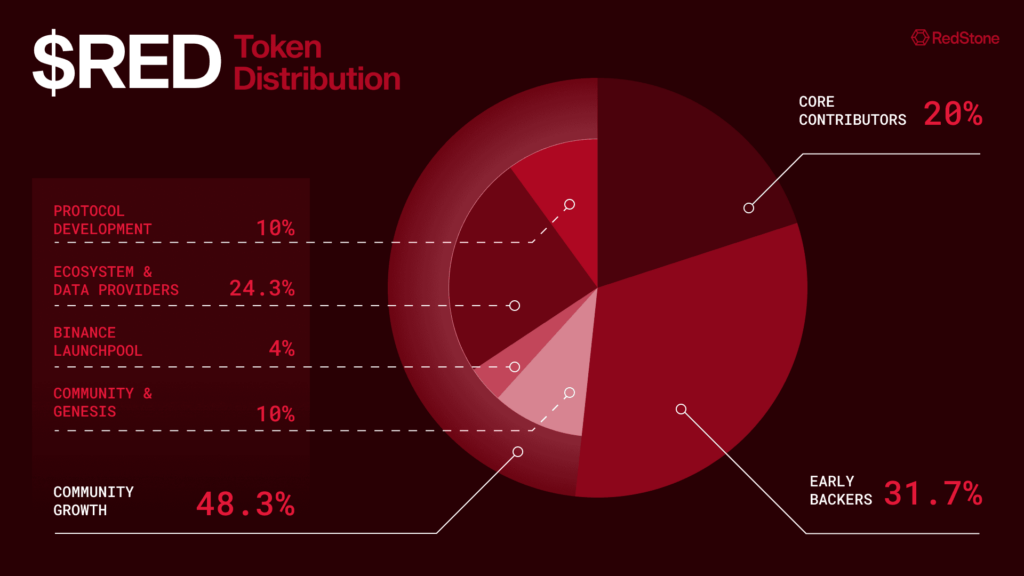

The tokenomics of RED are structured to promote growth and engagement within its ecosystem. Ten percent is allocated for community rewards, encompassing airdrops and early claims, while another ten percent is dedicated to research and development. Core contributors are assigned 20% of the tokens, subject to a vesting schedule. Additionally, 4% is earmarked for collaboration with Binance to enhance accessibility to RED tokens. To drive ecosystem expansion, 24.3% is reserved for data providers, while early supporters receive the most substantial share at 31.7%, also governed by a vesting schedule to ensure market stability.