Quant Price Displays Rare Trend: Forecasting a 70% Increase

The value of Quant has experienced a significant increase in recent months, driven by new partnerships with the European Central Bank and Oracle. This development has generated a unique chart pattern, indicating potential future gains in the weeks ahead.

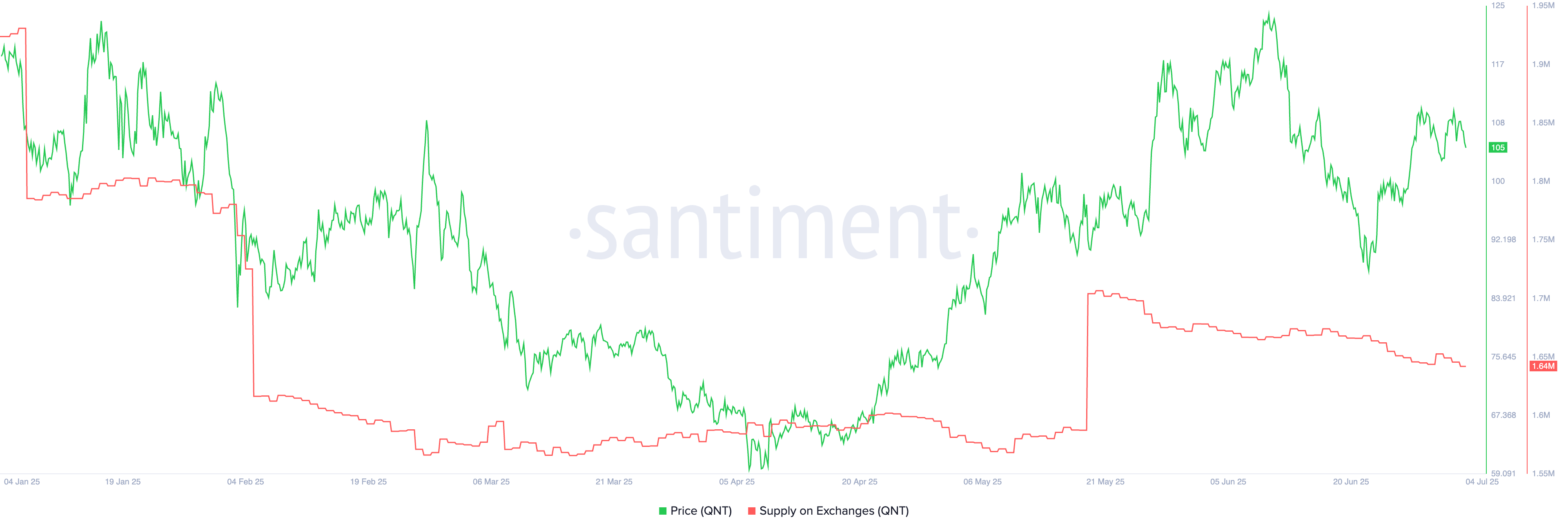

On July 4, Quant (QNT) was trading at $105, reflecting an impressive rise of over 75% from its lowest point this year. This increase has propelled its market capitalization to exceed $1.2 billion, positioning it as the 60th largest cryptocurrency.

Quant Network gained traction earlier this year when Oracle launched the Oracle Blockchain Platform Digital Assets Edition, which leverages Quant’s technology. OBP DA is aimed at enhancing the development and execution of digital asset applications at the enterprise level.

This platform streamlines and accelerates tokenization processes by integrating a strong distributed ledger framework with ready-made smart contracts. Oracle incorporates Quant’s Overledger solution in this offering.

The rally for Quant Network progressed as it was selected as one of the companies assisting the European Central Bank in the creation of a digital euro. There are expectations that the ECB may also adopt Quant’s Overledger solution, which serves as a blockchain-agnostic operating system facilitating interoperability between various blockchain networks and traditional systems.

Furthermore, Quant’s valuation may be positively influenced by advancements in Fusion, a framework designed to protect assets, data, and logic across both public and permissioned distributed ledgers.

The launch of Fusion’s Devnet took place last week, with a testnet rollout anticipated this month. The mainnet is expected to follow “within months,” with the mainnet+ to come after.

In parallel, on-chain analytics indicate that the quantity of QNT tokens on exchanges has declined to 1.64 million, its lowest level since May 25, suggesting that investors are moving their tokens to self-custody wallets.

Technical Analysis of Quant Price

The daily chart indicates that QNT hit a low of $59.25 in April before rebounding to $120 in June. It has formed a cup-and-handle pattern, identified by two distinct swings and a rounded base. The recent pullback represents the handle portion of this formation.

The difference between the cup’s upper and lower limits is approximately 50%. If we extrapolate this distance upwards from the top of the cup, it suggests a potential upward movement towards $180, representing a 71% increase from the current value. However, this optimistic scenario would be invalidated if the token falls below the support level of $85.78.