China Stock Rally Anticipated to Decelerate as AI Investment Reaches Saturation, Survey Shows

Analysts caution that the momentum of Chinese stocks may slow as the year ends, given that valuations are becoming more stretched. This uncertainty leads to questions about the sustainability of market recovery spurred by AI advancements and supportive policies.

The median forecast from 16 analysts and investment managers surveyed by Bloomberg predicts that the CSI 300 Index will conclude the year at approximately 4,675 points. This marks a modest increase of 1.2% from Monday’s closing, following a year-to-date rise of 17%. Expectations for 2026 remain cautious, with just a 5.5% rise anticipated by the end of next June, based on an informal poll conducted from September 18 to September 24.

The survey results reflect a cautious outlook; while easing China’s “uninvestable” status, significant concerns remain. Geopolitical tensions, erratic Trump-era policies, and a sluggish economy are keeping substantial capital out of the market, even with AI-driven trading and a temporary reconciliation with the U.S. on tariffs.

“The priority for 2025 will be maintaining stability,” stated Haris Khurshid, chief investment officer at Karobaar Capital, a participant in the survey. “Although there is policy support, it is inconsistent, and global investors are hesitant to embrace more risk until geopolitical issues are resolved.”

Survey participants also anticipate a 2% increase in the Hang Seng Index by year-end from its current level.

ADVERTISEMENT

CONTINUE READING BELOW

‘Crowded’ AI Trade

This year’s impressive rally in China has primarily been fueled by enthusiasm for AI-related sectors and technology. The Hang Seng Tech Index has surged by 42%, significantly driven by domestic chipmakers like Hua Hong Semiconductor Ltd. and Semiconductor Manufacturing International Corp., which experienced increases of over 233% and 140%, respectively. Alibaba Group Holding Ltd. saw nearly a 50% surge in September following substantial AI funding announcements.

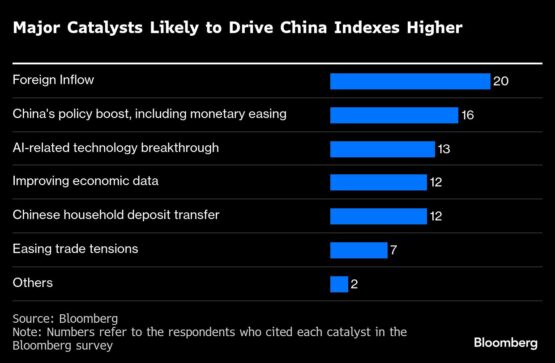

A reevaluation of China’s technology sector, along with signs of increasing foreign investment, has generated optimism for a continued upward trend. Almost all of the 21 respondents in the survey identified foreign capital as crucial for the next phase of this rally.

Nevertheless, concerns about inflated valuations are rising, with 12 respondents identifying AI as the most overcrowded sector. “Every yuan spent on AI capex leads to a higher share price, but eventually, investors will look for actual cash flows rather than just announcements,” Khurshid noted.

Policy Support

As the last quarter approaches, investors are seeking catalysts such as consumer activity during the Golden Week holiday, China’s Fourth Plenary Session, the Trump-Xi meeting at APEC, the Central Economic Work Conference in December, and any potential actions from the People’s Bank of China (PBOC).

Approximately half of the respondents foresee the PBOC implementing stimulus measures by year’s end, with the potential for a Federal Reserve rate cut creating room for additional easing. However, Khurshid anticipates only modest actions from the central bank.

ADVERTISEMENT:

CONTINUE READING BELOW

“The PBOC has signaled that it is ready to intervene if growth faces additional challenges,” he said. “I expect small, targeted measures rather than a sweeping stimulus program.”

While the holiday and governmental discussions may not significantly change the economic outlook in the short term, announcements regarding policy alterations could help restore market confidence, according to Meng Shen, director at the Beijing-based investment bank Chanson & Co. and a survey participant.

Sectors expected to benefit from the upcoming Fourth Plenary Session, set for October, include AI, infrastructure, semiconductors, new energy vehicles, services, and real estate, as noted by respondents.

However, next year may bring a clearer picture of China’s economic reality. Short-term policy boosts may fade as full-year GDP data and other essential metrics are released.

“Without new topics to divert investor attention, market rationality may return,” Shen stated.

© 2025 Bloomberg

Stay updated with Moneyweb’s comprehensive finance and business news on WhatsApp here.