A16z Crypto’s Comprehensive Step-by-Step Guide

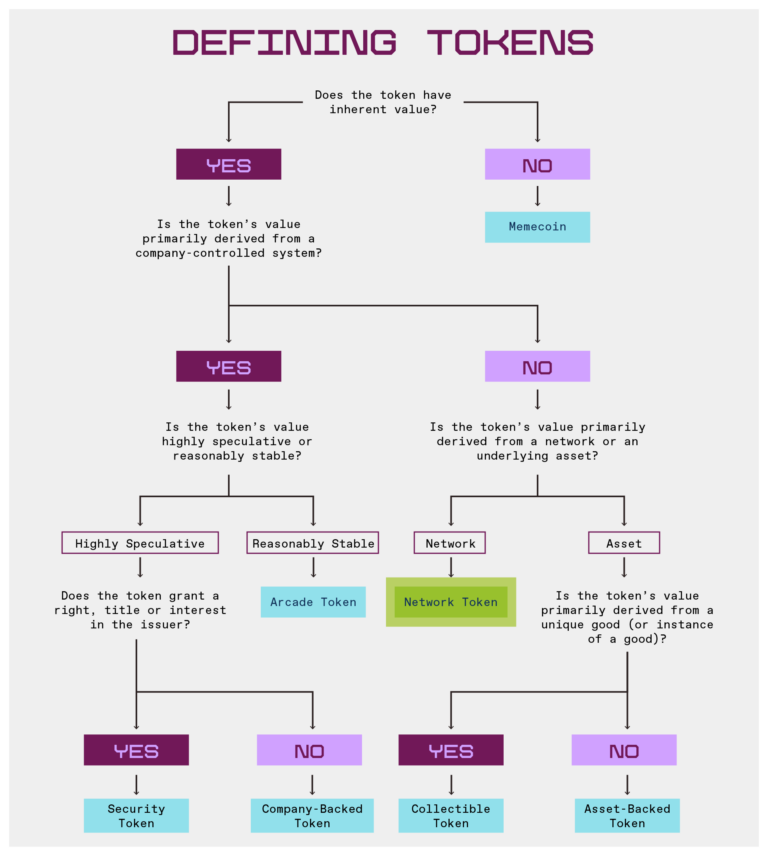

From network tokens to meme coins, a16z crypto has established a framework to assist businesses in navigating the dynamic cryptocurrency landscape.

What constitutes a cryptocurrency? According to Wikipedia, it describes a digital currency intended to function through a computer network that is “not reliant on any central authority, such as a government or bank, to uphold or maintain it.”

Initially, in 2009, there was only one cryptocurrency known as Bitcoin (BTC). However, the landscape has significantly evolved since then. There are now over 12 million different tokens, according to data from crypto price aggregator platforms. So how can we distinguish between them? Types include memecoins, utility tokens, security tokens, and more. It’s no surprise that the crypto world has grown increasingly complex.

“Therefore, whether you’re developing a blockchain project, investing in tokens, or simply using them as a consumer, understanding key distinctions is crucial. For example, one must not confuse memecoins with network tokens.”

a16z crypto

To assist in clarifying these concepts, Miles Jennings, Scott Duke Kominers, and Eddy Lazzarin from a16z crypto crafted a framework outlining the seven categories of tokens that entrepreneurs frequently develop. Below is a detailed overview of these categories.

Network tokens

Network tokens are essential for maintaining the operation of a blockchain or smart contract protocol. Their value is derived from the network’s functionality, often serving a clear role like facilitating network operations, achieving consensus, upgrading protocols, or rewarding specific actions within the network.

According to a16z crypto, these networks typically feature attributes such as “programmatic buybacks, dividends, and other adjustments to the overall token supply through creation or burning to create inflationary and deflationary dynamics that support the network.”

Network tokens rely on trust; thus, a16z crypto notes these tokens “share similarities with both commodities and securities.”

“Acknowledging this, both the SEC’s 2019 Framework and FIT21 permitted network tokens to be exempt from U.S. securities laws, provided that trust dependencies are minimized through the decentralization of the underlying network.”

a16z crypto

These tokens are deployed for launching new networks, distributing ownership, or ensuring network security. Noteworthy examples include Bitcoin, Ethereum (ETH), Solana (SOL), Uniswap (UNI), and Dogecoin (DOGE).

Security tokens

While network tokens may appear to be securities, security tokens are essentially digital counterparts to traditional securities, such as corporate shares or bonds. They can offer unique features, including profit-sharing interests in an LLC or rights to future settlements from lawsuits.

Security tokens provide specific rights, titles, or interests to holders, with the issuer typically managing the asset’s risk. According to a16z crypto, these tokens fall under U.S. securities laws. Although less prevalent than network tokens or memecoins, they’ve still been utilized to fund various business initiatives.

Company-backed tokens

Company-backed tokens are associated with an off-chain application, product, or service managed by a centralized organization.

Similar to network tokens, company-backed tokens may utilize blockchain and smart contracts (e.g., to facilitate payments). However, their primary focus is on off-chain operations rather than network ownership, giving the company increased control over the token’s issuance, utility, and value.

While these tokens don’t confer specific rights or titles as traditional securities do, they exhibit trust dependencies similar to those seen in securities.

“Their value is fundamentally tied to a system overseen by an individual, company, or management team.”

a16z crypto

This reliance means that company-backed tokens may fall under U.S. securities laws when they attract investment, as analysts caution. Historically, these tokens have been used to bypass U.S. securities regulations as substitutes for equity or profit interests in businesses.

For example, FTT represented profit interests in the controversial FTX exchange, while Binance Coin (BNB) transitioned into a network token after launching BNB Chain.

Arcade tokens

Arcade tokens are primarily utilized within specific systems and are not intended for investment, as explained by a16z crypto. These tokens often act as currencies in virtual economies, such as digital currencies in games, loyalty points in membership programs, or credits for digital products.

What distinguishes arcade tokens is their design to discourage speculation. They may have an unlimited supply—allowing for the minting of an infinite number—or limited transferability.

According to a16z crypto, these tokens can “expire or depreciate if not utilized, or they may possess monetary value and utility solely within the platform they are issued.” Generally speaking, arcade tokens do not promise financial returns, making them largely exempt from U.S. securities laws.

Examples include FLY, the loyalty token for the Blackbird restaurant group, and Pocketful of Quarters, an in-game asset that received regulatory relief from the U.S. Securities and Exchange Commission in 2019.

Collectible tokens

One of the most recognized types of tokens is collectible tokens. They can symbolize items like artwork, music pieces, or concert tickets. Publicly, they are often referred to as NFTs, or non-fungible tokens. While NFTs may appear to be part of a speculative trend, they can provide utility in specific contexts.

“A collectible token might serve as a license or ticket to an event; could be utilized in a video game (like that sword); or provide ownership rights to intellectual property.”

a16z crypto

Since collectible tokens typically relate to finished products and don’t depend on third-party efforts, they are generally exempt from U.S. securities regulations, as noted by a16z crypto. Highly recognized NFTs include Bored Ape Yacht Club and CryptoPunks.

Asset-backed tokens

Asset-backed tokens derive their value from claims on underlying assets, which can include commodities, fiat currency, or even cryptocurrencies.

These tokens may be fully or partially collateralized and serve various functions like acting as stores of value or hedging instruments. However, in contrast to collectible tokens, which gain value from unique goods, asset-backed tokens resemble financial instruments. According to a16z crypto, the “regulatory treatment of asset-backed tokens depends on their structure and intended use.”

Examples include fiat-backed stablecoins like Circle’s USD Coin (USDC), liquidity provider tokens like Compound’s C-tokens, or derivative tokens like OPYN’s Squeeth.

Memecoins

Lastly, we have memecoins—arguably the most well-known category. They represent the epitome of internet chaos, offering little to no practical utility and primarily revolving around memes or community hype. Their fundamentals? Forget about it. Their value is driven almost entirely by speculation and market sentiment, rendering them exceedingly easy to manipulate or subject to rug pulls.

Due to their chaotic nature, memecoins are typically “excluded from U.S. securities laws,” according to a16z crypto, though they still operate under anti-fraud and market manipulation regulations. What sets them apart? They lack purpose or genuine utility, and their prices can exhibit extreme volatility, making them unsuitable for investment. Notable examples include Pepe (PEPE), Shiba Inu (SHIB), and the new Official Trump (TRUMP) memecoin associated with former U.S. President Donald Trump.